Use the following to answer questions

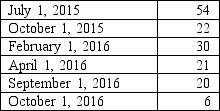

On June 1,2015,the Crocus Company began construction of a new manufacturing plant.The plant was completed on October 31,2016.Expenditures on the project were as follows ($ in millions) :

On July 1,2015,Crocus obtained a $70 million construction loan with a 6% interest rate.The loan was outstanding through the end of October,2016.The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 8%.This note was outstanding during all of 2015 and 2016.The company's fiscal year-end is December 31.

On July 1,2015,Crocus obtained a $70 million construction loan with a 6% interest rate.The loan was outstanding through the end of October,2016.The company's only other interest-bearing debt was a long-term note for $100 million with an interest rate of 8%.This note was outstanding during all of 2015 and 2016.The company's fiscal year-end is December 31.

-In computing the capitalized interest for 2016,Crocus' average accumulated expenditures are:

Definitions:

TSX

The TSX refers to the Toronto Stock Exchange, a major global exchange located in Canada, primarily featuring Canadian-based companies.

Listing Requirements

Listing requirements are the criteria established by stock exchanges that companies must meet to be listed and continue trading on the exchange.

Ontario Securities Commission

A regulatory agency responsible for overseeing the capital markets in Ontario, Canada, ensuring fair and transparent practices.

Shareholders

Individuals or entities that own one or more shares of stock in a public or private corporation, giving them partial ownership and usually voting rights.

Q12: Rahal's 2016 bad debt expense is:<br>A)$2,100.<br>B)$2,340.<br>C)$4,080.<br>D)None of

Q34: Using the double-declining balance method,depreciation for 2016

Q51: Cheney Company sold a 20-ton mechanical draw

Q63: The ending inventory under a periodic inventory

Q82: The FASB's required accounting treatment for research

Q85: The factors that need to be determined

Q91: ATC's gross profit ratio (rounded)in 2016 is:<br>A)53.4%.<br>B)51.9%.<br>C)50.3%.<br>D)None

Q96: The disclosure note indicates an inventory liquidation

Q131: On April 1 of the current year,Troubled

Q156: Under IAS No.39,transfers of debt investments out