Use the following to answer questions

Montana Mining Co.(MMC) paid $200 million for the right to explore and extract rare metals from land owned by the state of Montana.To obtain the rights,MMC agreed to restore the land to a suitable condition for other uses after its exploration and extraction activities.MMC incurred exploration and development costs of $60 million on the project.

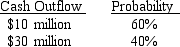

MMC has a credit-adjusted risk free interest rate is 7%.It estimates the possible cash flows for restoring the land,three years after its extraction activities begin,as follows:

-The asset retirement obligation (rounded) that should be recognized by MMC at the beginning of the extraction activities is:

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a company's assets over time.

Units-Of-Activity

A depreciation method that allocates the cost of an asset over its useful life based on the number of units it produces or the hours it operates.

Double-Declining-Balance

An accelerated method of depreciation that doubles the standard depreciation rate, resulting in higher depreciation expenses in the earlier years of an asset's life.

Residual Value

The salvage value of an asset after its period of use has ended, reflecting its remaining worth.

Q5: In a perpetual inventory system,the cost of

Q9: Listed below are five terms followed by

Q11: Any method of depreciation should be both

Q34: Wang Corporation purchased $100,000 of Hales Inc.6%

Q59: Under International Financial Reporting Standards,development expenditures are:<br>A)Expensed

Q64: Under the net method,purchase discounts lost are:<br>A)Included

Q75: Required: Compute the missing amounts.<br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2444/.jpg"

Q88: A company uses the allowance method to

Q105: Baker Inc.acquired equipment from the manufacturer on

Q120: Under International Financial Reporting Standards (IFRS),inventory is