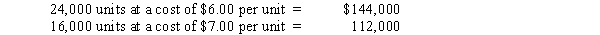

The Foxworthy Corporation uses a periodic inventory system and the LIFO inventory cost method for its one product.Beginning inventory of 40,000 units consisted of the following,listed in chronological order of acquisition:

During 2016,inventory quantity declined by 18,000 units.All units purchased during 2016 cost $8.00 per unit.

Required:

Calculate the before-tax LIFO liquidation profit or loss that the company would report in a disclosure note assuming the amount determined is material.

Definitions:

Cultural Beliefs

The shared norms, values, and practices that are learned from society and influence behaviors and perceptions.

Dying Process

The sequence of physical and emotional changes that lead to the end of life.

Palliative Team

A multidisciplinary group of healthcare professionals dedicated to improving the quality of life for patients with serious illnesses via symptom management and support.

Severe Pain

A high level of discomfort or distress, often requiring immediate medical intervention for relief.

Q10: On January 1,2015,ECT Co.adopted the dollar-value LIFO

Q11: Any method of depreciation should be both

Q19: During periods of falling prices,LIFO ending inventory

Q30: Koko Company pays $10 million at the

Q32: The conventional cost-to-retail percentage (rounded)is:<br>A)82.6%.<br>B)66.7%.<br>C)71.9%.<br>D)75.5%.

Q35: Cashmere Soap Corporation had the following items

Q89: Interest capitalized for 2017 was:<br>A)$104,625.<br>B)$ 86,805<br>C)$ 87,875.<br>D)$

Q106: Staff Accounting Bulletin No.101 was issued by

Q115: Listed below are five terms followed by

Q123: On February 20,2016,Genoa Mining Company incurred costs