Use the following to answer questions

The following note disclosure is taken from the 2016 annual report to shareholders of Winchester International Corporation.

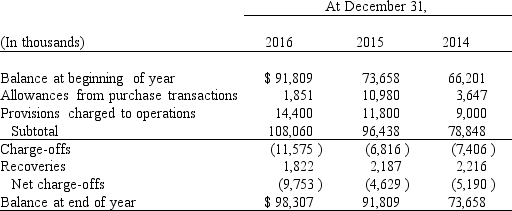

NOTE 5: ALLOWANCE FOR LOAN LOSSES

The allowance for loan loss is maintained at a level to absorb probable losses inherent in the loan portfolio.This allowance is increased by provisions charged to operating expense and by recoveries on loans previously charged off,and reduced by charge-offs on loans.

The following is a summary of the changes in the allowances for loan losses for three years:

Winchester also reported (in thousands)in its comparative balance sheet that it held Loans receivable,net,of $6,869,911 and $6,819,209 at December 31,2016,and December 31,2015,respectively.

Winchester also reported (in thousands)in its comparative balance sheet that it held Loans receivable,net,of $6,869,911 and $6,819,209 at December 31,2016,and December 31,2015,respectively.

-If Winchester is using the balance sheet approach to determining loan losses and the Allowance account balance,what percentage did it use in 2016?

Definitions:

Records

Pieces of information or data that are stored and managed as part of a larger dataset or database, often consisting of multiple fields to represent different attributes.

Matching Records

Instances in databases or datasets where two or more records are identical or meet specified criteria for similarity.

Customers Table

A structured data representation in databases specifically designed to store customer-related information.

Sales Table

A structured summary of sales transactions, typically including data on products, quantities, prices, and dates.

Q1: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2444/.jpg" alt=" " class="answers-bank-image d-block" rel="preload"

Q31: Holmgren Seafoods,Inc.catches and processes salmon and tuna

Q34: Briefly describe why companies that use perpetual

Q56: Interest capitalized for 2016 was:<br>A)$48,000.<br>B)$42,000.<br>C)$60,000.<br>D)$36,000.

Q82: The FASB's required accounting treatment for research

Q117: Under the gross method,purchase discounts taken are:<br>A)Deducted

Q154: A common output method used to measure

Q182: Revenue on a long-term contract should not

Q191: Its asset turnover ratio for 2016.Round your

Q219: Prepare Romano's April 30 journal entry to