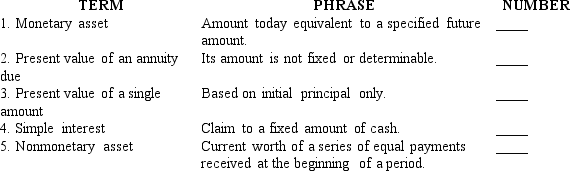

Listed below are 5 terms followed by a list of phrases that describe or characterize each of the terms.Match each phrase with the number for the correct term.

Definitions:

Deferred Taxes

Taxes that are assessed or levied for one period but deferred to a future period for payment.

Consolidated Balance Sheet

A financial statement that combines the assets, liabilities, and equity of a parent company and its subsidiaries into one document to provide a comprehensive overview of the financial position of the entire group.

Tax Rate

The percentage rate at which an individual or corporation is taxed.

Gross Profit

The difference between revenue and the cost of goods sold before administrative and other expenses are deducted.

Q3: Monica wants to sell her share of

Q47: Canton Corporation reported the following items in

Q54: It's not unusual for one company to

Q59: The purpose of assigning accounts receivable is

Q90: The Filzinger Corporation's December 31,2016 year-end trial

Q101: Explain how you would compute the imputed

Q169: Its receivables turnover ratio for 2016.Round your

Q209: The amount of variable consideration that can

Q243: A contract between a seller and a

Q296: Companies recognize revenue only when<br>A)A contract is