Use the following to answer questions

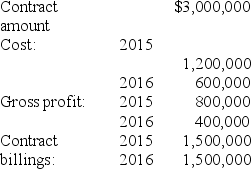

Sahara Desert Homes (SDH)reports under IFRS and constructed a new subdivision during 2015 and 2016 under contract with Cactus Development Co.Relevant data are summarized below:

SDH uses the cost recovery method under IFRS to recognize revenue.

SDH uses the cost recovery method under IFRS to recognize revenue.

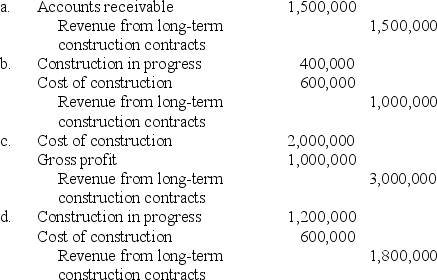

-What is SDH's journal entry to record revenue in 2016?

Definitions:

Revenue Recognition

An accounting principle that determines the specific conditions under which income becomes realized or realizable, and thus recognized as revenue.

Property Taxes

Taxes levied by local governments based on the assessed value of real property.

Revenue Recognition

The accounting principle that revenue should be recorded when it is earned, regardless of when the payment is received.

Q12: Prepare Portelli's April 30 journal entry to

Q14: When revenue is recognized over time versus

Q57: Which of the following is not true

Q66: Salaries and wages have been earned but

Q93: A sale on account would be recorded

Q95: Assume that at the time of signing

Q123: Kline's 12/31/16 total shareholders' equity:

Q123: A company is effectively leveraging when:<br>A)The return

Q227: Summary data for Benedict Construction Co.'s (BCC)Job

Q246: What is the expected transaction price with