Use the following to answer questions

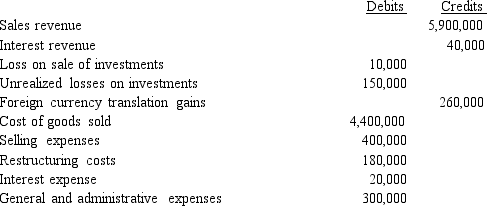

The trial balance of Rollins Inc.included the following accounts as of December 31,2016:

Rollins had 100,000 shares of stock outstanding throughout the year.Income tax expense has not yet been accrued.The effective tax rate is 40%.

Rollins had 100,000 shares of stock outstanding throughout the year.Income tax expense has not yet been accrued.The effective tax rate is 40%.

-Required: Prepare a 2016 multiple-step income statement for Rollins Inc.with earnings per share disclosure.

Definitions:

Skills Implementation

Skills implementation is the process of applying newly acquired abilities and knowledge in practical settings to achieve specific objectives.

Post-Training Supplements

These are nutritional or informational resources provided after a training session to support recovery and enhance the effects of the training.

Purpose

The reason for which something is done or created or for which something exists.

Training Intervention

A Training Intervention is a structured program designed to improve performance and address specific skill gaps or needs among employees through targeted instruction.

Q2: An 18-month-old child is admitted to the

Q3: The home health nurse is visiting a

Q9: Which of the following would take priority

Q14: Based on physical findings, including a webbed

Q29: Briefly define discontinued operations and explain how

Q57: Change in equity from nonowner sources is:<br>A)Comprehensive

Q62: The difference between single-step and multiple-step income

Q90: The Filzinger Corporation's December 31,2016 year-end trial

Q114: Which of the following statement is most

Q240: An option for a customer to purchase