Required:

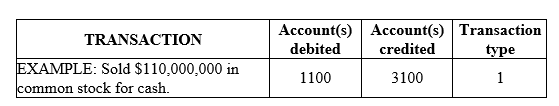

Using the chart of accounts provided, indicate by account number the account or accounts that would be debited and credited in the following transactions. Also enter the number 1, 2, or 3 to indicate the type of transaction as: (1) an external transaction, (2) an internal transaction recorded as an adjusting journal entry, or (3) a closing entry. The company uses a perpetual inventory system. All prepayments are initially recorded in permanent accounts

-Collected cash on account from customers.

Definitions:

Levy

A tax imposed by a government on goods, services, or financial transactions.

Consumption

The use of goods and services by households, which represents the final phase in the economic chain of activities.

Inferior Good

A type of good for which demand decreases as the income of consumers increases, opposite to normal goods.

Income

Money received on a regular basis from work, property, business, or investments.

Q7: FlexMotors,Inc.manufactures a variety of electronic drills and

Q12: The woman has a normal pregnancy except

Q22: When converting an income statement from a

Q35: Listed below are 5 terms followed by

Q95: Listed below are 10 organizations followed by

Q113: Listed below are five terms followed by

Q265: CompuLand Center sells a full assortment of

Q266: Briefly explain the circumstances in which license

Q317: Its return on assets for 2016.Round your

Q319: Beck Construction Company began work on a