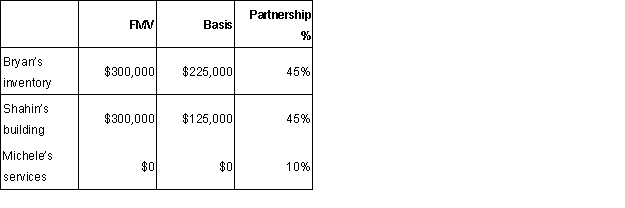

Bryan, Shahin, and Michele form a partnership. Bryan and Shahin contribute inventory and a building, respectively. Michele agrees to perform all of the accounting and office work in exchange for a 10% interest.  a. Do any of the partners recognize any gain? If so, how much and why?

a. Do any of the partners recognize any gain? If so, how much and why?

b. What is each partner's basis in his or her partnership interest?

c. What is the basis to the partnership of each asset?

Definitions:

Withdrawal

The act of removing oneself from participation or involvement in a particular activity, situation, or substance use.

Dyad

The smallest social group consisting of two persons, involved in a continuous interaction, forming a basic unit of social organization.

Coalition

An alliance for combined action, especially a temporary alliance of political parties forming a government or of states.

Wellman's Research

Pertains to the work of Barry Wellman, a sociologist known for his studies on social networks, community sociology, and the impact of the internet on society.

Q10: A distribution from a retirement plan is

Q14: If Randolph Co. has sales of $3,000,000,

Q34: Household workers are subject to FUTA tax

Q42: A qualifying individual for purposes of the

Q78: Free cash flow is equal to cash

Q86: The higher the profit of a firm,

Q86: Daniel is a computer technical support representative

Q87: C Corporations are not permitted to report

Q99: In the past, the study of finance

Q134: The American opportunity tax and lifetime learning