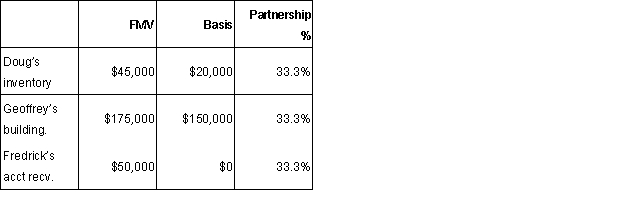

Doug, Geoffrey, and Fredrick form a partnership and contribute the following assets:  Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

Geoffrey's building has a mortgage of $135,000 which the partnership assumes.

a. Do any of the partners recognize any gain? If so, how much and why?

b. What is each partner's basis in his or her partnership interest?

c. What is the basis to the partnership in each asset?

d. What are the holding periods to the partnership for each asset?

e. How would your answer change with respect to Geoffrey if his basis in the building was $85,000?

Definitions:

Symbolic Interactionism

A sociological perspective that focuses on how individuals interpret and give meaning to social interactions and symbols.

Social Situations

Circumstances that involve interactions between individuals in a societal setting.

Behaviors

Actions or reactions of an individual or group in response to external or internal stimuli, which can be observed and measured objectively.

Praxis

The process by which theory, lesson, or skill is enacted, embodied, or realized.

Q27: TEW COMPANY<br>Balarce Sheet<br>As of Decermber 31<br>

Q31: The Tara Partnership (not involved in real

Q38: <span class="ql-formula" data-value="\begin{array} {c } \text {MARNI

Q40: The withholding tables are structured so that

Q72: TTT Corporation has a fiscal year-end that

Q92: The purchase of a new factory building

Q97: The Anderson Company started its business on

Q106: The Dodd-Frank Act was created by Congress

Q107: An employer with 250 or more employees

Q107: Grape Corporation makes a nonliquidating distribution of