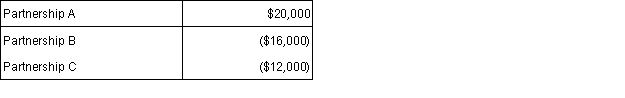

Spencer has an ownership interest in three passive activities. In the current tax year, the activities had the following income and losses:  How much in passive losses can Spencer deduct?

How much in passive losses can Spencer deduct?

Definitions:

Social Isolation

A state where an individual lacks a sense of belonging, social engagement, or meaningful contact with others.

Powerlessness

The feeling of lacking control or influence over one's circumstances or outcomes.

Bullying

Intimidation or aggressive behavior by an individual or group towards others, often characterized by repetition and a power imbalance.

Cultural Identity

The sense of belonging to a group that shares common cultural traits such as language, traditions, and customs.

Q2: Denise's AGI is $145,000 before considering her

Q4: Sarah is single with no dependents. During

Q4: Laverne exchanges a rental beach house with

Q13: Assuming a tax rate of 21%, depreciation

Q15: Sabrina has a $12,000 basis in her

Q15: Warren and Erika paid $9,300 in qualified

Q35: Gain realized on a like-kind exchange is

Q57: K. Kruse Designs has the following employees:

Q80: A corporation can deduct a charitable contribution

Q108: The Internet impacts e-commerce by creating a