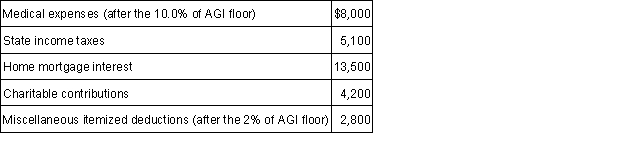

Cal reported the following itemized deductions on his 2015 tax return. His AGI for 2015 was $85,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total itemized deductions.

Definitions:

Biased Population

A group in which certain characteristics are over- or underrepresented, leading to skewed or unrepresentative sample outcomes.

Statistically Significant Population

A population size or characteristic in which differences or effects observed are unlikely to be due to chance, typically determined through statistical tests.

Representative Sample

A subset of a population that accurately reflects the members of the entire population, used in research to draw conclusions about the population as a whole.

Random Sample

A method of selecting a sample from a population in which each individual has an equal probability of being chosen.

Q1: Corporate governance issues have become less important

Q26: Louis, who is single, sold his house

Q43: Generally, guaranteed payments do not have an

Q46: Which of the following is not subtracted

Q52: What are the tax consequence(s) related to

Q55: Paris, a 60% partner in Omega Partnership,

Q57: On December 28, 2015, Misty sold 300

Q106: All C corporations file their tax returns

Q112: All of the following are common examples

Q124: Teal Corporation has taxable income of $320,000.