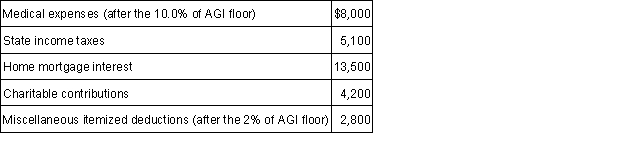

Cal reported the following itemized deductions on his 2015 tax return. His AGI for 2015 was $85,000. The mortgage interest is all qualified mortgage interest to purchase his personal residence. For AMT, compute his total itemized deductions.

Definitions:

Digital Signature

An electronic form of a signature that provides secure and verifiable identification of the signer.

Digital ID

A form of electronic identification used to validate the identity of individuals or entities online.

Inspect Document

A feature found in many word processing and office programs that allows users to check for personal information or hidden metadata that might be stored in a document before sharing it.

3-D Effect

A 3-D effect in graphics and design gives a three-dimensional appearance to flat graphics, creating an illusion of depth.

Q4: In order to be eligible for the

Q38: Barrie owns 100% of a Subchapter S

Q40: If a partner contributes services on the

Q55: Which of the following relationships are considered

Q64: When a firm's earnings are falling more

Q66: Institutional investors have had increasing influence over

Q74: If Crossroads International has $3,000,000 in total

Q87: In the case of the adoption credit,

Q116: There is unlimited liability in a general

Q123: Individuals who make contributions to a Coverdell