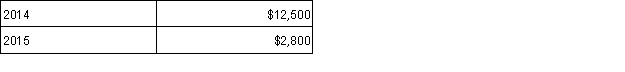

After years of working with the orphanage and the government, Walt and Kim adopted a little girl from China. The adoption process, which became final in January 2015, incurred the following qualified adoption expenses. What amount of adoption credit can Walt and Kim claim and in what year? Assume there is no credit limitation due to their AGI amount.

Definitions:

Unit of Product

This term refers to a single complete product that is ready for sale or has passed through one complete stage of production.

Departmental Overhead Rate Method

An accounting method used to allocate overhead costs to specific departments based on relevant activity bases.

Overhead Resources

The ongoing operational costs required to run a business that are not directly tied to a specific product or service, such as rent, utilities, and general office supplies.

Activity Pool

A concept in cost accounting used to gather all costs associated with a certain activity, facilitating more accurate cost allocation.

Q2: Denise's AGI is $145,000 before considering her

Q12: In the case of a primarily personal

Q37: Adjustments to AMTI can be either positive

Q47: If a taxpayer cannot specifically identify which

Q62: In order to deduct a charitable contribution,

Q70: When royalties are paid, at the end

Q74: The gain or loss on the sale

Q80: What is qualified residence interest? Are there

Q116: Supplemental wage payments include all the following

Q129: The earned income credit is available for