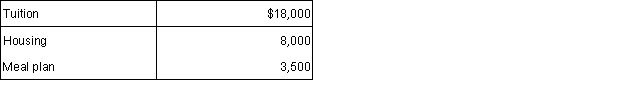

Sam paid the following expenses during October 2015 for his son Aaron's spring 2016 college expenses: Spring 2016 semester begins in January 2016:  In addition, Aaron's uncle paid $500 for college fees on behalf of Aaron directly to the college. Aaron is claimed as Sam's dependent on his tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Sam in 2015?

In addition, Aaron's uncle paid $500 for college fees on behalf of Aaron directly to the college. Aaron is claimed as Sam's dependent on his tax return. How much of the paid expenses qualify for purposes of the education credit deduction for Sam in 2015?

Definitions:

Perfectly Competitive Market

An economic market setup in which there are numerous buyers and sellers dealing in identical products with no obstacles for entering or leaving the market.

Long-run Equilibrium

The state in which all factors of production and costs are variable, and firms make neither excess profit nor losses, indicating stability in the market.

Perfectly Competitive

A market structure characterized by many buyers and sellers, homogeneous products, free entry and exit, and perfect information, resulting in firms being price takers.

Price

The amount of money required to purchase a good or service; the value that must be exchanged to acquire a specific product.

Q5: Harrison is single and his son Jack

Q8: Employers withhold income tax only on tips

Q19: If a loss is disallowed under passive

Q31: Mahmet earned wages of $118,650 during 2015.

Q38: The "similar or related in service or

Q51: Matt and Opal were married in April

Q63: SIMPLE and SEP plans are subject to

Q65: Individuals who are active participants in an

Q104: Employers with a payroll tax liability of

Q113: Assume a taxpayer is qualified to receive