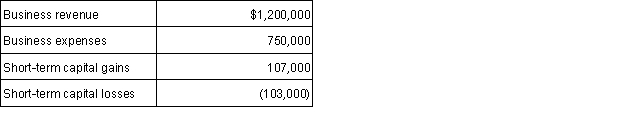

Ariel, Bob, Candice and Dmitri are equal partners in a local ski resort. The resort reports the following items for the current year:  Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

Definitions:

Federal Personal Income Tax

A tax levied by the federal government on the yearly income of individuals, with the rate applied varying according to the income level.

Progressive Taxes

A tax system in which the tax rate increases as the taxable amount increases, placing a higher tax burden on individuals with higher incomes.

Proportional Taxes

A tax system where the tax rate remains constant regardless of the amount on which the tax is imposed, resulting in taxes being proportionate to the income.

Direct Taxes

Taxes paid directly to the government by the individual or organization on whom it is levied, such as income tax or property tax.

Q1: Xavier bought furniture and fixtures (7-year property)

Q3: Under a court-ordered decree of separate maintenance

Q3: Royalties can be earned from allowing others

Q4: A stock dividend in which a shareholder

Q13: The maximum allowable American opportunity tax credit

Q16: Glenn sells a piece of equipment used

Q55: Flow-through entities supply each owner at the

Q57: The two methods that may be used

Q109: What is the maximum deductible contribution that

Q109: A royalty is a payment for the