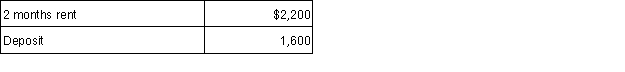

Naomi and Matt received the following amounts from a tenant who is renting their condominium during the current year (rent is $1,500 per month) :  Rent for two months would normally have been $3,000, but the tenant paid $800 for a plumbing repair. The repair would normally have been paid by Naomi and Matt but the problem occurred while they were out of town. How much should Naomi and Matt report as rental income for the current tax year?

Rent for two months would normally have been $3,000, but the tenant paid $800 for a plumbing repair. The repair would normally have been paid by Naomi and Matt but the problem occurred while they were out of town. How much should Naomi and Matt report as rental income for the current tax year?

Definitions:

Q33: Which of the following is not deductible

Q36: Keiko sells a piece of equipment used

Q55: George is a single father who has

Q72: Donna and Walt paid $3,000 in qualified

Q79: What is meant by a penalty on

Q83: Credit for child and dependent care expenses

Q87: In the case of the adoption credit,

Q89: Contributions to a qualified pension plan can

Q92: GTW Inc., did not make timely deposits

Q93: Lisa performed bookkeeping services for Donald charging