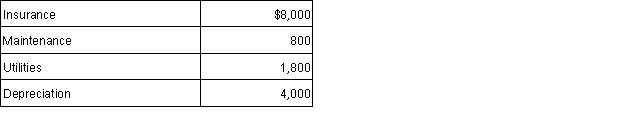

Stephen and Joy own a duplex in Newport Beach, CA. They live in one unit and rent the other to another couple. Their rental income for the year was $24,000. They incurred the following expenses for the entire duplex:  What amount of net income from the duplex should Stephen and Joy report for the current year?

What amount of net income from the duplex should Stephen and Joy report for the current year?

Definitions:

Q47: Angie earned $120,000 during 2015. She is

Q56: Maeda Company has the following employees on

Q61: In 2015, Maria who is 43, had

Q68: The amount of self-employed health insurance premiums

Q89: Lourdes, a sole proprietor, collected $8,650 on

Q93: Flow-through entities are named as such because

Q94: Short-term capital losses first reduce 28% gains,

Q103: Georgia owns a home in Colorado that

Q111: All tax-deferred pension plans have an accumulation

Q114: The adjusted gross income limitation on casualty