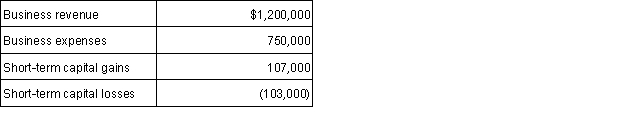

Ariel, Bob, Candice and Dmitri are equal partners in a local ski resort. The resort reports the following items for the current year:  Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

Each partner receives a Schedule K-1 with one-fourth of the preceding items reported to him/her. How must each individual report these results on his/her Form 1040?

Definitions:

Professional Codes of Ethics

Sets of guidelines designed to outline acceptable behaviors and decision-making processes for professionals within specific industries.

Q10: The maximum allowable credit for the elderly

Q15: Richard owns a cabin in Utah that

Q23: Arturo and Deena are married with two

Q29: Royalties can be earned from allowing others

Q33: All of the following statements regarding Section

Q49: When royalties are paid, the amount paid

Q59: Robert and Becky (husband and wife) are

Q63: What are the requirements that the taxpayer

Q68: Depreciation is allowed for every tangible asset

Q106: The calculation for the credit for the