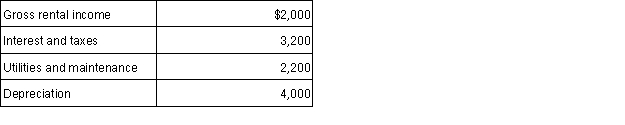

Lori and Donald own a condominium in Colorado Springs, Colorado, that they rent out part of the time and use during the summer. The rental property is classified as personal/rental property and their personal use is determined to be 75% (based on the IRS method) . They had the following income and expenses for the year (before any allocation) :  How much netloss should Lori and Donald report for their condominium on their tax return this year?

How much netloss should Lori and Donald report for their condominium on their tax return this year?

Definitions:

Operational Definition

A precise description of how variables will be measured or manipulated in a study.

Anxiety

A sense of apprehension or fear, often related to a forthcoming event or a situation with an unpredictable result.

Incongruity

The state of being out of place or not in harmony, often leading to surprise or humor due to the unexpected mismatch.

Operational Definition

A concise and detailed explanation of a variable, defined by the methods or actions employed to assess or control it.

Q25: Richard's business is condemned by the state

Q37: The ownership test for the sale of

Q38: Generally, a taxpayer uses Schedule C to

Q47: What are the criteria that determine an

Q51: Esmeralda is single and is paid $759

Q59: Puri is a self-employed Spanish teacher. Her

Q70: Tanner, who is single, purchased a house

Q84: Which of the following statements regarding the

Q106: An annuity is a series of payments

Q112: In the case of defined-contribution plans, in