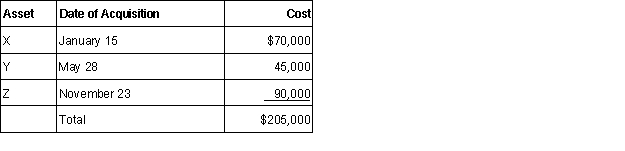

Tonia acquires the following 5-year class property in 2015:  Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Definitions:

Accounting Treatment

The methodology and guidelines used to represent an accounting process or transaction in the financial statements, according to principles of accounting standards.

Comparability

An accounting principle that allows financial information to be compared across different periods or companies for analysis.

Financial Information

Data related to the financial status and activities of an individual, company, or organization.

Similar Manner

Describes actions or processes conducted in a way that is analogous or comparable to another, often used to ensure consistency.

Q12: What is the amount of the tax

Q26: A taxpayer is married with a qualifying

Q28: For 2015, Lydia had adjusted gross income

Q49: A single taxpayer cannot file a Form

Q57: K. Kruse Designs has the following employees:

Q78: Often, individuals who purchase a home with

Q94: David and Martha were divorced on December

Q96: The basic standard deduction in 2015 for

Q99: Which of the following items would not

Q109: A taxpayer who either is 65 or