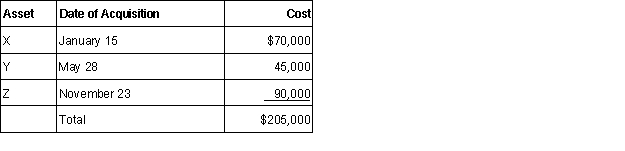

Tonia acquires the following 5-year class property in 2015:  Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Tonia does not elect §179 or bonus depreciation. Tonia has $300,000 of taxable income from her business. Determine her total cost recovery deduction for the year.

Definitions:

Virus-free

Describes a digital environment, file, or device that is not infected with any malicious software or viruses.

Attachments

Files sent along with an email message or linked within documents to provide additional information.

Antivirus Program

Software designed to detect, prevent, and remove malware and viruses from computers and networks.

Virus-free

A state in which a computer or digital environment is devoid of malicious software or viruses.

Q30: Rental activities by definition are passive activities.

Q37: Royalty income is income received from the

Q40: If an activity is characterized as a

Q41: Demetrius had a $4,000 short-term loss and

Q52: Arlene is a college professor earning $90,000

Q68: The amount of the standard deduction increases

Q70: Kim paid the following expenses during November

Q91: Which one of the following items is

Q91: When the buyer assumes the seller's liability,

Q100: Jury duty pay is taxable income, but