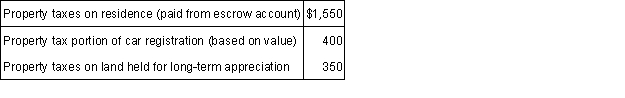

During 2015, Sam paid the following taxes:  What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

What amount can Sam deduct as property taxes in calculating his itemized deductions for 2015?

Definitions:

Insomnia

A sleep disorder characterized by difficulty falling and/or staying asleep, affecting a person's quality of sleep and, consequently, their overall health and well-being.

REM Behavior Disorder

A sleep disorder characterized by the acting out of dreams due to the lack of normal muscle paralysis during REM sleep phases.

Conscious

The state of being aware of and responsive to one's surroundings and internal thoughts and feelings.

Sleep

A naturally recurring state of rest for the mind and body, characterized by altered consciousness, relatively inhibited sensory activity, and inhibition of nearly all voluntary muscles.

Q7: Taxpayers normally pay their tax liability when

Q24: What was the amount of the personal

Q51: During 2015, Manuel and Gloria incurred acquisition

Q55: For 2015, sales taxes are deductible as

Q68: The maximum amount per year of dependent

Q93: Deductible moving expenses may include moving household

Q103: Morris redeemed $6,000 (principal of $4,500 and

Q109: The cost of a chiropractor's services does

Q110: Josephine gave her son, Shane 700 shares

Q119: Norman received shares of stock as a