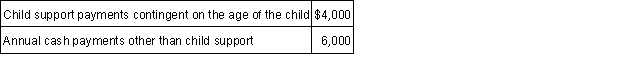

Rick and Lenora were granted a divorce in 2014. In accordance with the decree, Rick made the following payments to Lenora in 2015:  How much should Lenora include in her 2015 taxable income as alimony?

How much should Lenora include in her 2015 taxable income as alimony?

Definitions:

Role Models

Individuals admired for their ways of living or success, who influence others by setting good examples.

Arrogance

Characterized by or revealing an exaggerated sense of one’s own importance or abilities.

Self-Selected Stakeholder

A person who chooses themselves to have an interest or investment in an initiative or project without being appointed or elected.

Mentor

An experienced and trusted advisor who provides guidance, knowledge, and support to less experienced individuals or startups.

Q2: Otis, the taxpayer, has the following capital

Q6: The _ HTML5 element is used to

Q14: In terms of dollars, wage-earning taxpayers will

Q28: For tax purposes, marital status is determined

Q31: Which of the following would disqualify a

Q58: What is the definition of a proportional

Q63: The forms used to report a gain

Q66: Juan paid the following amounts of interest

Q74: The accuracy-related penalty applies when negligence or

Q92: In order to qualify for a Health