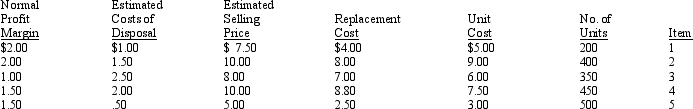

The Peter Park Company began operations in early 2013. At December 31, 2013, the company's ending inventory's cost was $12,950. The market value of the inventory at this date was $11,800. Peterson values its inventory at lower of cost or market applied on an individual item basis and uses a perpetual inventory system. Below is information relating to Peter's inventory at December 31, 2014:

Required:

a.Assuming that the company uses the allowance method, prepare the required entry at December 31, 2013, to record the inventory at lower of cost or market.

b.Prepare a schedule to calculate the inventory's value as of December 31, 2014, using the lower of cost or market method. The schedule should contain the following column headings: Item, Upper Constraint, Lower Constraint, Applicable Unit Inventory Value, Number of Units, and Total Inventory Value.

c.Prepare the required entry at December 31, 2014, to record the inventory at lower of cost or market. Assume the allowance method is used.

Definitions:

Stockholders

Individuals or entities that own shares of stock in a corporation, giving them ownership interest.

Dividends Payable

A liability on a company's balance sheet that represents the amount of dividends that have been declared but not yet paid to shareholders.

Cash Payments

Transactions in which money is paid out by a business, often for expenses, debts, or purchases.

Indirect Method

A technique used in cash flow statement preparation that adjusts net income for changes in non-cash accounts to reveal net cash from operating activities.

Q4: When a company writes off an account

Q28: Monkeys, apes, and humans are all classified

Q33: Which of the following statements regarding the

Q43: Conceptually, all liabilities should be reported on

Q53: For an event or transaction to be

Q59: Refer to Exhibit 9-2. At what amount

Q76: On September 1, 2013, Geco Co. sold

Q77: For only a merchandiser, the sum of

Q104: Reporting inventory at the lower of cost

Q108: For valuation of inventory, the lower of