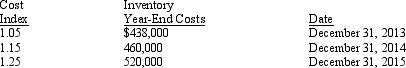

Exhibit 7-5 Sullivan Produce Co. switched from FIFO to LIFO on January 1, 2013, for external reporting and income tax purposes, while retaining FIFO for internal reports. On that date, the FIFO inventory equaled $360,000. The ensuing three-year period resulted in the following:

-Refer to Exhibit 7-5. The ending inventory at December 31, 2014, using the dollar-value LIFO method would be

Definitions:

Gain on Sale

The profit realized from the sale of assets other than inventory, calculated as the sale proceeds minus the carrying value of the asset sold.

Debt Investments

Financial assets purchased with the expectation that the investment will generate interest income and be repaid in the future.

Interest Accrual

The recognition of interest earned or payable that has accumulated but not yet been recorded or paid.

Debt Investments

Investments made by purchasing bonds or other debt instruments, with the expectation of earning interest income and the return of principal.

Q10: In order for an external user of

Q24: A purchase on credit is recorded twice

Q49: All of the following are examples of

Q49: Which of the following are components of

Q60: Refer to Exhibit 7-3. Assuming Davis uses

Q70: On January 1, 2014 Hammer Company listed

Q70: All of the following payroll taxes are

Q117: Under what conditions can a short-term obligation

Q139: What two types of financing agreements are

Q148: Which application of the lower of cost