The following are transactions of the Morrison Company:

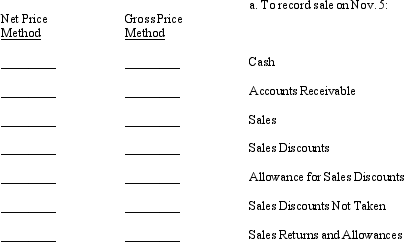

a.On November 5, sold merchandise on account for $46,000 with terms of 3/15, n/30.

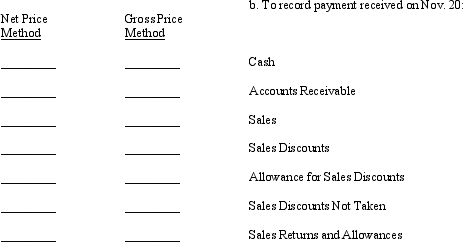

b.On November 20, payment was received on $32,000 worth of merchandise sold on November 5.

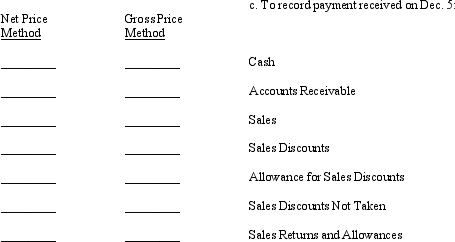

c.On December 5, further collections were made on $8,000 of merchandise sold on November 5.

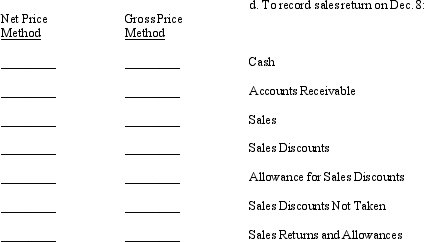

d.On December 8, merchandise sold for $4,000 on November 5 was returned by the purchaser and credit was granted by Morrison Company. Required:

Record the appropriate amounts under the gross price and net price methods in the spaces below. For each method, write the amount to be debited or credited on the appropriate line for each account shown. Indicate that the amount is a debit or credit by placing a (d) or (c) after the amount.

Definitions:

Automobile Factory

A manufacturing facility where cars are produced, involving assembly lines and parts fabrication processes.

Null Hypothesis

An assumption in statistical analysis that proposes no significant relationship or difference exists among specified groups or variables.

Energy Consumption

The amount of energy utilized by specific processes, devices, systems, or by a society, typically measured in units such as joules, kilowatt-hours, or calories.

U.S. Regions

Geographic areas in the United States characterized by specific climatic, cultural, economic, or demographic traits.

Q18: Morris Corp. uses dollar-value LIFO. Certain information

Q20: Under IFRS, liabilities and shareholders' equity on

Q43: .....

Q50: On January 1, 2014, Peg, Inc.

Q54: What is FASB's definition of fair value?

Q79: Which of the following cannot be used

Q96: Special journals, including the sales, purchases, cash

Q98: What are the cost flow assumptions available

Q118: Left Images Printing uses perpetual LIFO in

Q125: Laura's Homemade cannot decide which inventory method