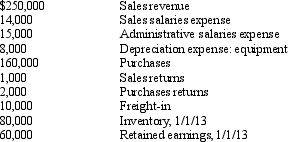

The following accounts are taken from the accounting records of Dory Company at December 31, 2013, after adjustments:

In addition, the following information is available: 1In addition, the following information is available:

•The inventory on December 31, 2013, was $75,000.

•Ten thousand shares of common stock were outstanding during the entire year. Dory paid dividends of $1.00 per share.

•At the end of October, Dory sold its unprofitable restaurant component. From January through October, the component had incurred an operating loss (pretax) of $14,000. The sale was made at a loss (pretax) of $8,000.

•In November, the company sold the only land it ever owned for a gain of $10,000.

•The applicable tax rate is 30%.

Required:

Prepare a 2013 multiple-step income statement for the Dory Company.

Definitions:

Legal Fees

Legal fees are charges for the advice and services provided by lawyers, including consultation, representation in court, and the preparation of legal documents.

Employee Turnover

The rate at which employees leave a company and are replaced by new employees, impacting organizational knowledge and continuity.

Moonlighting Unethically

Engaging in secondary employment that conflicts with one's primary job duties or interests, violating ethical or contractual obligations.

Real Fires

Actual incidents of uncontrolled burning, which can cause damage to properties and environments and require emergency response.

Q1: Below are selected accounts taken from the

Q10: In certain circumstances a company may find

Q11: Which ratios are the most commonly analyzed

Q20: Figure APC-1 is the condensed worksheet for

Q34: A compensating balance used to secure a

Q40: In interim reporting, a LIFO liquidation requires

Q49: If the transferor of accounts receivable cannot

Q97: All of the following items would appear

Q101: Realization of revenue occurs when<br>A) the item

Q101: In a period of rising prices what