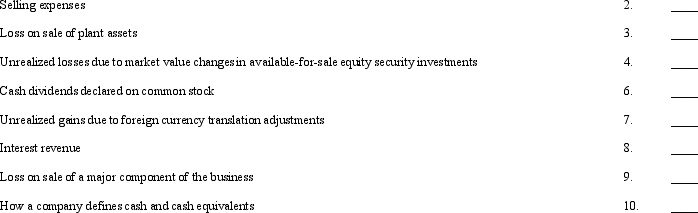

For income reporting purposes, items can appear in any of the following components of the income statement, the statement of retained earnings, and related schedules and footnotes: a. income from continuing operations or supporting schedules

b. extraordinary gains or losses

c. results from discontinued operations

d. statement of comprehensive income

e. statement of retained earnings

f. disclosure

Several items of accounting information are listed below:  Required:

Required:

By placing the letters (a-f) in the spaces provided above, identify where the information would be most appropriately reported. If the information would not appear in any of the above components, place an (X) in the space.

Definitions:

Federal Income Tax

A tax levied by the United States federal government on the annual earnings of individuals, corporations, trusts, and other legal entities.

Withheld

The portion of an employee's income that an employer retains as mandated by law or agreement, typically for taxes or other deductions.

Matched by Employer

A benefit where an employer matches the contributions their employees make to a retirement plan, up to a certain percentage.

Installment Note Payable

A debt instrument that requires a series of payments over a specified period until the full amount is paid off.

Q25: On a worksheet, which account will not

Q43: Reversing entries should not be made for

Q56: Earnings per share is an important disclosure

Q67: Describe the differences in the application of

Q79: Refer to Exhibit 21-1. What is Raymonds'

Q83: Accounts Payable Turnover in Days and Inventory

Q86: Walter Co. made the following errors in

Q87: On January 1, 2014, Margo Company acquired

Q100: Which of the following is not considered

Q101: In a period of rising prices what