Listed below are ten terms describing the purposes of the balance sheet. Following the list is a series of descriptive phrases.

a. financial position

b. balance sheet

c. income statement

d. liquidity

e. financial flexibility

f. operating capability

g. assets

h. acquisition cost

i. control

j. recognition

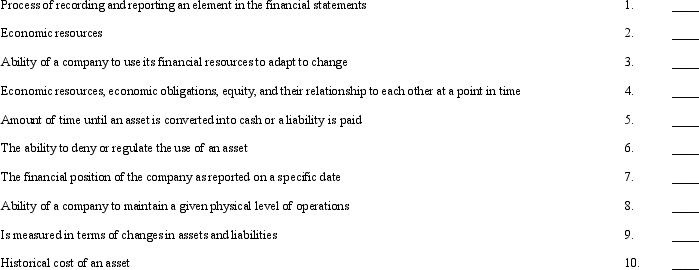

1.Process of recording and reporting an element in the financial statements

2.Economic resources

3.Ability of a company to use its financial resources to adapt to change

4.Economic resources, economic obligations, equity, and their relationship to each other at a point in time

5.Amount of time until an asset is converted into cash or a liability is paid

6.The ability to deny or regulate the use of an asset

7.The financial position of the company as reported on a specific date

8.Ability of a company to maintain a given physical level of operations

9.Is measured in terms of changes in assets and liabilities

10.Historical cost of an asset

Required:

Required:

Match each term with its descriptive phrase by placing the appropriate letter in the space provided.

Definitions:

Fair Values

The potential earning from disposing of an asset or the fiscal responsibility to transition a liability in an agreeably organized interaction with market entities at the moment of judgement.

Common Stock

Equity shares representing ownership in a company, giving holders voting rights and a share in the company’s profits through dividends.

Goodwill

An intangible asset that arises when a company acquires another for a price higher than the fair value of its net assets, representing items such as brand reputation or customer loyalty.

Par Value

The nominal value designated by the issuer for a bond or stock, which doesn't reflect its actual market price.

Q5: An operating segment is significant and reportable

Q42: Which statement is false?<br>A) Salaries expense +

Q62: The Slater Company uses the cash basis

Q64: On January 1, 2014, Donna Company leased

Q65: To be considered cash the funds must

Q87: Several items to be considered in converting

Q93: Under the direct method a company deducts

Q96: Which of the following is a counterbalancing

Q110: The adjustment necessary to convert payments for

Q114: A lessee reports noncash investing and financing