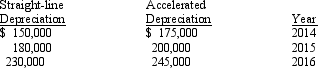

The Max Company began its operations on January 1, 2014, and used an accelerated method of depreciation for its machinery and equipment. On January 1, 2016, Max adopted the straight-line method of depreciation. The following information is available regarding depreciation expense for each method:

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2016, due to changing to a different depreciation method?

Definitions:

Democratic Party Split

Refers to divisions within the Democratic Party, often caused by ideological differences, policy disputes, or clashes between personalities, impacting party unity and electoral strategies.

Slavery In The Territories

A contentious pre-Civil War issue in the United States, centered around whether new territories should allow slavery, impacting the balance of power between free and slave states.

Popular Sovereignty

Program that allowed settlers in a disputed territory to decide the slavery issue for themselves; most closely associated with Senator Stephen A. Douglas of Illinois.

Abraham Lincoln

The 16th President of the United States, who served from 1861 until his assassination in 1865, known for leading the country during the Civil War and abolishing slavery.

Q26: Which statement is true?<br>A) In the Income

Q33: Which of the following criteria would not

Q41: The first part of the conceptual framework

Q52: FASB's financial reporting model identifies which specific

Q59: Leah Co. reported $7,000 of net income

Q97: All of the following items would appear

Q100: Jamison Company is preparing its statement of

Q102: Probable future sacrifices of economic benefits arising

Q108: The entire group of accounts for a

Q132: Flagstaff, a lessor, entered into a sales-type