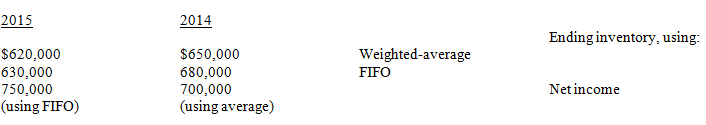

The Opal Company was incorporated and began operations on January 1, 2014. Opal used the weighted-average method for costing inventories. Effective January 1, 2015, Opal changed to FIFO for costing inventories and can justify the change. Information related to 2014 and 2015 inventory cost and net income is presented below:

Opal's income tax rate is 30% for both 2014 and 2015.

Required:

Calculate the amount of the cumulative effect of the change on beginning retained earnings on January 1, 2015, that would appear on Opal's statement of retained earnings for the year ended December 31, 2015.

Definitions:

Group Discussion

A structured conversation or meeting focused on a particular topic, where multiple individuals share ideas, suggestions, and opinions.

Affirmative Action

Policies or measures that aim to increase opportunities for historically disadvantaged groups by considering those very characteristics (such as race or gender) in decisions like employment and education.

Same-Sex Unions

Legal or socially recognized partnerships between two individuals of the same sex, akin to marriage.

Deindividuation

A psychological state where an individual loses self-awareness and self-restraint, often occurring within group contexts.

Q14: Meagan Co. has the following errors on

Q33: The Maggie Company has a defined benefit

Q35: According to current GAAP, leased property could

Q40: Obligations that are not expected to require

Q45: Refer to Exhibit 4-1. Blue Bell's accounts

Q74: The primary purpose of financial reporting is

Q84: The accounting equations is<br>A) Assets = Liabilities

Q126: Refer to Exhibit 20-5. If Baltimore requires

Q127: The income statement reports<br>A) revenue and expenses

Q146: (This problem requires use of present value