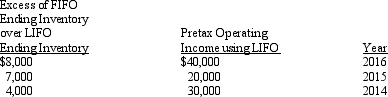

Tulip Company decided to change from LIFO to FIFO inventory costing, effective January 1, 2016. The following data were available:

The income tax rate is 35%. The company began operations on January 1, 2014, and has paid no dividends since inception.

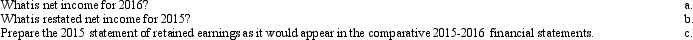

Required:

Answer the following questions relating to the 2015-2016 comparative financial statements.

Definitions:

R&D Consortia

Collaborative groups made up of companies, universities, or government agencies that work together on research and development projects.

Lightweight Putter

A golf club designed with reduced weight to improve control and accuracy on the green.

Customer Input

The feedback or data provided by customers used to improve or develop products and services.

Customized Business Software

Software that is specifically designed and developed to meet the unique requirements and workflows of a particular business or organization.

Q10: The task of developing the conceptual framework

Q24: A company must fund its pension plan

Q25: On January 1, 2014, Rhyme Co. leased

Q27: What are the advantages of using the

Q35: If the trial balance does not balance

Q47: On June 1, 2014, Little Corporation received

Q56: The following information relates to the Stork

Q59: Which of the following items is NOT

Q90: The mandatory adoption of a new accounting

Q137: Which of the following facts would preclude