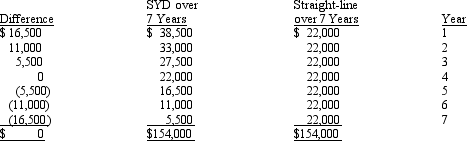

On January 1, Year 1, the Dole Company purchased an asset that cost $154,000. The asset had an expected useful life of seven years and no estimated residual value. The company initially decided to use sum-of-the-years'-digits (SYD) depreciation for both financial accounting and income tax purposes. Depreciation expense for the straight-line method and the sum-of-the-years'-digits method is as follows:

Definitions:

Contracture

Permanent shortening or contraction of a muscle.

Skeletal Muscle Tissue

A type of muscle tissue that is attached to bones and is responsible for voluntary movements of the body.

Smooth Muscle Tissue

A type of muscle tissue found in the walls of hollow organs like the intestines and blood vessels, which contracts involuntarily.

Motor Unit

A single motor neuron and all the muscle fibers it innervates, working together to perform muscular contraction.

Q1: For reporting operating cash flows under the

Q9: Refer to Exhibit 21-3. Net cash provided

Q23: Liquidity is positively related to financial flexibility

Q26: The income statement information for 2014 and

Q59: Which of the following accounts would not

Q62: Which of the following is a required

Q73: South Bend Corporation purchased equipment in December

Q93: Under the direct method a company deducts

Q103: In a statement of cash flows, which

Q131: The gross profit of Larry Company for