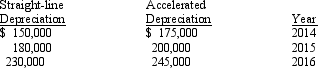

The Max Company began its operations on January 1, 2014, and used an accelerated method of depreciation for its machinery and equipment. On January 1, 2016, Max adopted the straight-line method of depreciation. The following information is available regarding depreciation expense for each method:

What is the before-tax cumulative effect on prior years' income that would be reported as of January 1, 2016, due to changing to a different depreciation method?

Definitions:

Complexes

A core pattern of emotions, memories, perceptions, and wishes in the personal unconscious organized around a common theme, such as power or status.

Conscious Control

The deliberate use of one's attention and decision-making to regulate thoughts, feelings, and actions.

Collective Unconscious

A term coined by Carl Jung, referring to the part of the unconscious mind which is derived from ancestral memory and experience and is common to all humankind.

Consciousness

The state of being aware of and able to think about oneself, one's surroundings, and one's thoughts and feelings.

Q19: GAAP states that a change in accounting

Q21: Which of the following errors normally would

Q25: On January 1, 2014, Rhyme Co. leased

Q28: What are the three type of accounting

Q63: The purpose of closing entries is to

Q68: The income statement is an important financial

Q82: From the lessee's point of view leasing

Q95: On January 1, 2014, Reynolda Co. leased

Q125: For a sale-leaseback transaction for which the

Q132: In distinguishing between revenues and gains, which