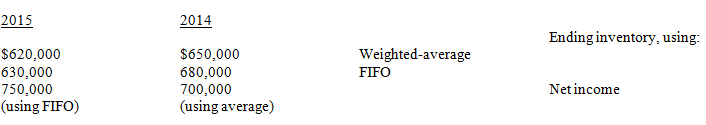

The Opal Company was incorporated and began operations on January 1, 2014. Opal used the weighted-average method for costing inventories. Effective January 1, 2015, Opal changed to FIFO for costing inventories and can justify the change. Information related to 2014 and 2015 inventory cost and net income is presented below:

Opal's income tax rate is 30% for both 2014 and 2015.

Required:

Calculate the amount of the cumulative effect of the change on beginning retained earnings on January 1, 2015, that would appear on Opal's statement of retained earnings for the year ended December 31, 2015.

Definitions:

Cognitive Development

The process by which individuals acquire and process knowledge through thought, experience, and the senses over time.

Preoperational

Refers to a stage in Piaget's theory of cognitive development, where children aged 2 to 7 years use symbols to represent their earlier sensorimotor discoveries but lack the ability to perform operations or use logic.

Cognitive Development

The process through which a person's ability to think, understand, and learn evolves over the course of their life, starting from infancy.

Symbolic Functions

Cognitive operations that enable a person to use symbols, signs, or objects to represent something that is not physically present.

Q16: A change in accounting estimate is always

Q26: On September 4, 2014, Chester Fish Company

Q51: On January 1, 2014, Sarah Company purchased

Q56: Listed below are ten terms describing the

Q82: Which statement is false?<br>A) The balance sheet

Q86: A list of statements follows: <br>a._are applications

Q90: Accounting information might be separately reported in

Q98: The following are totals from selected financial

Q112: If the fair value of land is

Q126: Refer to Exhibit 20-5. If Baltimore requires