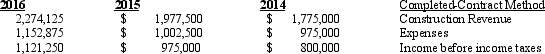

Shelley Construction began operations in 2014 and appropriately used the completed-contract method in accounting for its long-term construction contracts. The prepared the following information:

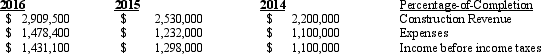

Effective January 1, 2016, Shelley changed to the percentage-of-completion method tax reporting and can justify the change; the company's tax rate is 35%. It determines the construction and revenue expense amounts under the percentage of completion method to be:

Required:

1) How would the company account for the change?

2) Prepare the journal entries to reflect the changes.

Definitions:

Highly Substitutable

Refers to goods or services that are readily replaced with alternatives by consumers due to minimal differences in characteristics or functionality.

Unit Costs of Production

The average cost incurred in producing one unit of a good, calculated by dividing the total cost of production by the number of units produced.

Related Resource

Assets or inputs that are connected or utilized together in the production process of goods or services.

Labor Demand

The total amount of workers that employers in the economy want to hire at any given wage rate.

Q2: Information reported or disclosed about the profit

Q22: In a statement of cash flows prepared

Q25: Which of the following liabilities is properly

Q30: When reading the Cash Outflows from Operating

Q37: Refer to Exhibit 22-3. If the revised

Q45: Disclosures for a defined benefit pension plan

Q64: On January 1, 2014, Donna Company leased

Q99: The statement of cash flows is least

Q116: <br>Refer to Exhibit 5-1. In the preparation

Q132: Flagstaff, a lessor, entered into a sales-type