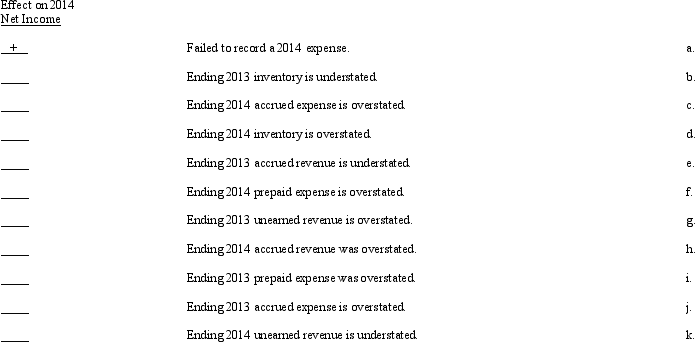

Several errors are listed below.

Required:

Indicate the effect each error would have on 2014 net income by placing a plus sign (+), minus sign (-) or NI (no impact) in the space provided. Part (a) has been completed as an example.

Definitions:

Independent-Samples T-Test

A statistical test used to determine if there is a significant difference between the means of two groups which are independent of each other.

Dependent-Samples T-Test

A numeric examination technique for assessing whether the mean values of two correlated groups differ significantly.

Regression

A statistical method used to determine the relationship between two or more variables, where one or more independent variables are used to predict the outcome of a dependent variable.

Analysis of Variance

A statistical procedure used to compare the means of three or more samples to determine if at least one of the sample means is significantly different from the others.

Q2: The accountant failed to make the adjusting

Q25: In situations where the change in accounting

Q30: The amount owed the IRS is recorded

Q32: Refer to Exhibit 22-6. By how much

Q35: Which of the following is not a

Q48: The following are accounting items taken from

Q53: Which of the following is not a

Q73: Which of the following statements regarding postretirement

Q104: On January 1, 2014, Suzanne Company purchased

Q140: Which statement is true?<br>A) All purchases should