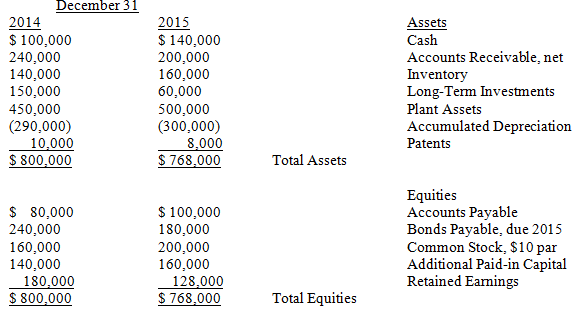

Exhibit 21-3 The Travis Company uses the spreadsheet method for completing the statement of cash flows. The balance sheet accounts and other information related to those accounts are presented below for Travis Company:  Additional information related to 2015 activities:

Additional information related to 2015 activities:

1.Net loss for 2015 was $40,000.

2.Cash dividends of $12,000 were declared and paid in 2015.

3.4,000 shares of common stock were issued to bondholders converting bonds payable into common stock.

4.A long-term investment was sold for $100,000 cash.

5.Equipment costing $100,000 and having accumulated depreciation of $30,000 was sold for $50,000 cash.

-Refer to Exhibit 21-3. Net cash provided (used) in the investing activities section of Travis's 2015 statement of cash flows was

Definitions:

Fixed Costs

Costs that do not vary with the level of production or sales, such as rent, salaries, and insurance.

Profit

The financial gain made in a transaction or business operation, calculated as the excess of revenue over expenses.

Unit Variable Costs

The costs associated with producing one unit of a product or service, which vary directly with the volume of production.

Fixed Costs

Fixed charges that are unaffected by the volume of output or the quantity sold, including rental fees and payrolls.

Q3: The expense for other postretirement benefits, such

Q18: The statement of cash flows, along with

Q41: The existence and term of renewal or

Q44: Rock Hall Financing leased some equipment to

Q67: In order to compute revenue the ending

Q72: Refer to Exhibit 22-3. If the revised

Q75: Taylor Corporation sold Division M (a business

Q96: Which of the following is typically the

Q97: All of the following items would appear

Q142: On January 1, 2014, Watson Company signed