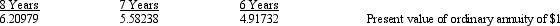

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

Definitions:

AGI

Adjusted Gross Income (AGI) is a measure of income calculated from your gross income and allows for certain deductions, serving as a basis for calculating taxable income.

Dependent Child

A child who relies on their parent or guardian for more than half of their financial support and meets certain IRS criteria for tax purposes.

Foreign Tax Credit

A tax credit that cannot be refunded for income taxes paid to an external government due to withholdings from foreign income tax.

Foreign Income Taxes

Taxes paid to a foreign government for income earned outside of the taxpayer's resident country.

Q6: Rhonda Company reported $70,000 of net income

Q7: Refer to Exhibit 21-2. The Cash Flows

Q26: Which of the following sets includes only

Q29: Understandability is a characteristic that is<br>A) a

Q37: Which of the following indicators relating to

Q64: What must be disclosed when making a

Q72: Deferrals are transactions, events, or arrangements in

Q75: A prior period adjustment can arise from

Q81: Life insurance proceeds payable to a corporation

Q85: Refer to Exhibit 17-4. How much deferred