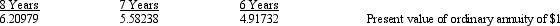

Davis Co., a lessor, signed a direct financing lease on January 1. The cost and fair value of the machine that was leased was $60,000. The implicit interest rate was 6%. The lease period was seven years, with the first payment due immediately. Actuarial information for 6% follows:

What is the annual lease payment to be collected by Davis?

Definitions:

Stock Up

To accumulate or gather a large quantity of goods or supplies, typically for future use.

Near-Fatal Experience

An incident or situation in which someone comes very close to losing their life.

Averse

Having a strong dislike of or opposition to something.

Younger Sister

A female sibling who is born after another child in the same family.

Q9: From the lessee's viewpoint, all of the

Q23: Liquidity is positively related to financial flexibility

Q33: The Maggie Company has a defined benefit

Q51: The statement of cash flows classifies cash

Q69: Rice, Inc. began operations on January 1,

Q72: In 2014, the Puerto Rios Company received

Q73: South Bend Corporation purchased equipment in December

Q105: Temporary differences arise when expenses or losses

Q112: Which accounts are increased with debits?<br>A) Cost

Q125: Langley Company received merchandise on December 31,