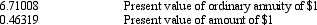

On January 1, 2014, Stephen Corp., a lessor, signed a direct financing lease. Stephen was to receive annual year-end payments of $10,000 for ten years, after which there was a guaranteed residual value of $8,000. The implicit interest rate was 8%. Actuarial information for 8%, ten periods follows: (round to the nearest whole dollar)

On January 1, 2014, Stephen should record a debit to Lease Receivable for

Definitions:

Maturity

The stage in a product’s lifecycle or a company’s growth where growth slows down, and it reaches a steady state of maximum output or sales.

Secured

Protected against threat or harm, or in financial terms, backed by collateral.

Venture Capitalist

An investor who provides capital to start-up companies or supports small companies that wish to expand but do not have access to equities markets.

Finance Manager

A professional responsible for managing the financial health of an organization, including planning, organizing, controlling, and monitoring financial resources.

Q1: According to GAAP, which is not a

Q12: Generally accepted accounting principles have identified four

Q31: A pension plan provides for future retirement

Q50: If a company has an agreement to

Q57: The corridor is defined as 10% of

Q61: On January 1, 2014, Cambridge Realty sold

Q62: Revenue recognition is defined as the accomplishments

Q92: Refer to Exhibit 20-4. Given the structure

Q104: The installment method is usually associated with<br>A)

Q138: Below is the chart of accounts for