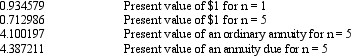

Exhibit 20-5 The Baltimore, Inc. entered into a five-year lease with the Waugh Chapel Company on January 1, 2014. Baltimore, the lessor, will require that five equal annual payments of $25,000 be made at the beginning of each year. The first payment will be made on January 1, 2014. The lease contains a bargain purchase option price of $12,000, which the lessee may exercise on December 31, 2018. The lessee pays all executory costs. The cost of the leased property and its normal selling price are $95,000 and $118,236, respectively. Collectibility of the future lease payments is reasonably assured, and the lessor does not expect to incur any future costs related to the lease. Present value factors for a 7% interest rate are as follows:

-Refer to Exhibit 20-5. If Baltimore requires a 7% annual return, what is the correct amount that should be credited to Unearned Interest: Leases on January 1, 2014, by Baltimore? (Round the answer to the nearest dollar.)

Definitions:

High Narcissism

A personality trait characterized by an inflated sense of self-importance, need for admiration, and a lack of empathy for others.

Cognitive Ability

The capacity to perform mental processes of perception, memory, judgment, and reasoning, affecting how well someone can learn and solve problems.

High Integrity

The quality of being honest and having strong moral principles.

Work Modes

Various approaches or methods adopted by individuals or groups in accomplishing tasks and achieving objectives in a work environment.

Q23: Refer to Exhibit 20-3. The annual lease

Q37: Intracompany comparability would be violated if<br>A) a

Q49: Current GAAP permits two methods of calculating

Q60: Which fundamental characteristic is an ingredient of

Q67: In order to compute revenue the ending

Q68: A list of statements follows: <br>a.GAAP identifies

Q72: Deferrals are transactions, events, or arrangements in

Q87: What are adjusting entries and why are

Q115: Posting is the procedure of transferring information

Q140: Which statement is true?<br>A) All purchases should