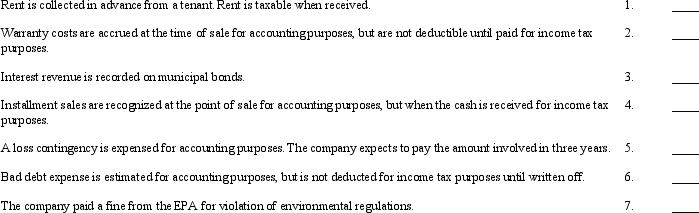

For each item listed below, indicate whether it involves a:

a.permanent difference.

b.temporary difference that will result in future deductible amounts (giving rise to deferred tax assets).

c.temporary difference that will result in future taxable amounts (giving rise to deferred tax liabilities).

Required:

Match each item to its descriptive phrase by placing the appropriate letter in the space provided.

Definitions:

Process Costing

A method of costing used where identical products are produced, allocating average costs for each unit.

Repetitive Production

A method of production where the same products are manufactured over and over again in a continuous flow.

Noncustomized Products

Refers to goods that are produced in large quantities without specific modifications for individual customers.

Process Costing Systems

An accounting method used to allocate costs to units of product in processes that mass produce similar items, calculating the cost per unit.

Q4: An abbreviated set of financial statements for

Q6: Bourne Company received rent in advance of

Q18: Permanent differences between pretax financial income and

Q27: Refer to Exhibit 14-2. The entry to

Q34: Refer to Exhibit 14-1. These bonds sold

Q41: If an employer were to account for

Q82: When is interest expense less than interest

Q84: If a company uses the indirect method

Q130: Refer to Exhibit 14-6. The journal entry

Q135: If a company is having trouble paying