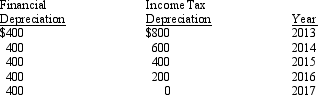

Pruett Corporation began operations in 2013 and appropriately recorded a deferred tax liability at the end of 2013 and 2014 based on the following depreciation temporary differences between pretax financial income and taxable income:

The income tax rate for 2013 and 2014 was 30%. In February 2015, due to budget constraints, Congress enacted an income tax rate of 35%. The journal entry required to adjust the Deferred Tax Liability account in February 2015 would be

Definitions:

Top-Level Domain

The highest level of domain names in the hierarchical Domain Name System, after the root domain.

Web-Based Applications

Applications that operate on the web and can be accessed through a web browser, eliminating the need for local installation.

Hashtags

A symbol (#) used before a word or phrase on social media to categorize content and facilitate a search for it.

Social Media

Websites or apps that allow users to create and share content and/or participate in social networking with others.

Q21: Which of the following events would be

Q23: Liquidity is positively related to financial flexibility

Q29: Which of the following methods could not

Q32: List the eight phases of the Joint

Q36: Which of the following items would not

Q58: If collectibility is reasonably certain or there

Q73: Refer to Exhibit 17-2. What amount of

Q83: Which of the following items would not

Q103: In certain respects, IFRS provide more principles-based

Q135: Corporate stockholders can only lose the amount