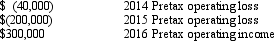

Moore Company reported the following operating results during its first three years of operations:

No permanent or temporary differences occurred during these fiscal periods. Assuming an income tax rate of 35%, Moore should report a current income tax liability as of December 31, 2016, in the amount of

Definitions:

Intellectual Differences

Variations in cognitive abilities among individuals, including differences in intelligence, reasoning, and problem-solving skills.

Genetic Differences

Variations in the DNA sequences among individuals, which contribute to the diversity of organisms' traits.

Environmental Differences

Variations in the physical, social, or cultural environment that can influence individuals' behavior and development.

Genetic Explanations

Descriptions or theories that attribute the cause of certain traits, behaviors, or conditions to genes and hereditary factors.

Q2: Differences between pretax financial income and taxable

Q19: Accounting regulators opted to recognize the liability

Q21: The Stansbury Company has issued 10%, partially

Q28: Refer to Exhibit 15-6. The estimated total

Q32: Under the fair value method, if an

Q40: Given the following convertible securities, determine the

Q48: What are the five categories that a

Q55: Refer to Exhibit 14-1. The discount at

Q100: Martian Magic issued 800 shares of $50

Q164: Refer to Exhibit 14-1. At date of