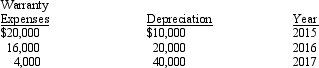

Delmarva Company, during its first year of operations in 2014, reported taxable income of $170,000 and pretax financial income of $100,000. The difference between taxable income and pretax financial income was caused by two timing differences: excess depreciation on tax return, $70,000; and warranty expenses in excess of warranty payments, $40,000. These two timing differences will reverse in the next three years as follows:

Enacted tax rates are 30% for 2014, 35% for 2015 and 2016, and 40% for 2017.

Required:

Prepare the income tax journal entry for Delmarva Company for December 31, 2014.

Definitions:

Leadership Skills

A set of abilities that an individual can possess or develop to effectively guide, influence, or direct a group towards the achievement of goals.

Dominant Leaders

Individuals who assert control or influence over others in group settings, often setting direction and making decisions.

Prestigious Leaders

Leaders who are admired and respected due to their success, authority, or excellence in their field.

Agreeableness

A characteristic of personality that entails being cooperative, kind, and sympathetic towards others, often associated with a tendency to avoid conflict and maintain social harmony.

Q7: Accounting principles are theories, truths, and propositions

Q7: Which of the following facts would require

Q18: Which of the following statements regarding the

Q59: The following information is provided regarding a

Q66: Refer to Exhibit 16-1. On January 2,

Q68: Assume common stock is issued to employees

Q69: Mark, Inc. amended its defined benefit pension

Q108: During 2014, Oddie Corp. had net income

Q109: On November 1, 2014, the Cranberry Construction

Q142: Refer to Exhibit 15-8. What is the