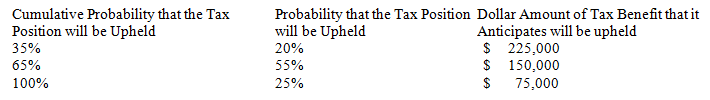

At the end of the current year, Brothers company claims a $225,000 tax credit on its income tax return. Brothers is uncertain about whether the IRS will accept the credit. After some research it is determined that the IRS may not accept all of the tax credit. Brothers estimates the likelihood using the following probability distribution:

Required:

For the current year determine:

1) the amount Brothers will be able to recognize as a current tax benefit

2) the amount that will be record as the unrecognized tax benefit.

Definitions:

Internal Control

Procedures and practices implemented by a company to safeguard its assets, ensure accurate financial reports, and ensure compliance with laws and regulations.

Cash Disbursements

The outflow of cash for expenses, investments, and other payments during a given period.

Internal Control

Processes designed to provide reasonable assurance regarding the achievement of various objectives such as the effectiveness and efficiency of operations.

Documentation Procedures

The processes and methods for systematically recording and organizing documents and records pertinent to business operations.

Q10: What are the four steps necessary to

Q41: The existence and term of renewal or

Q41: The Flintstone Company incurred the following expenses

Q49: Hagerstown Tanning & Spa sold 300 contracts

Q52: An excess of Construction in Progress over

Q59: Jones sells computer software to Wyatt that

Q75: Maher has entered into a lease agreement

Q101: One Republic Company leased equipment to Maps

Q126: Refer to Exhibit 20-5. If Baltimore requires

Q134: Refer to Exhibit 14-9. The entry to