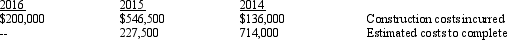

Exhibit 17-2 The following information relates to a project of the Cumberland Construction Company:

The contract price was $1,000,000. Cumberland used the percentage-of-completion method of revenue recognition.

-Refer to Exhibit 17-2. What amount of gross profit was recognized in 2014?

Definitions:

Sunk Costs

Sunk costs refer to money already spent and permanently lost, which cannot be recovered and should not influence future financial decisions.

Opportunity Costs

A rephrased definition: The potential gains or benefits that are lost when choosing one alternative over another in decision-making.

Gross Margin

The difference between sales revenue and the cost of goods sold, expressed as a percentage of sales revenue.

Income Statement

A financial statement that shows a company’s revenues, expenses, and profits or losses over a specific period.

Q2: The joint IASB and FASB boards identified

Q6: Bourne Company received rent in advance of

Q12: During 2014, Sanders, Inc. had the following

Q47: Which of the following statements is true

Q58: Which one of the following phrases is

Q72: In most states, it is illegal to

Q74: West, Inc. determined the following information concerning

Q83: Which of the following items would not

Q93: Refer to Exhibit 17-2. What amount of

Q149: When a company issues bonds, the selling