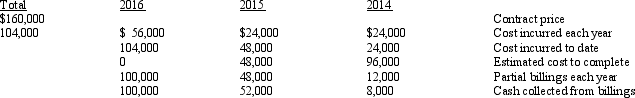

The Orlando Company is involved in a three-year long-term contract. The following data relate to this contract:

Required:

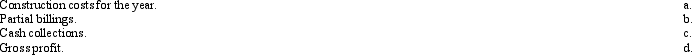

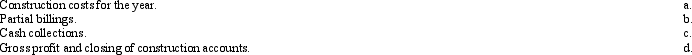

Prepare the journal entries to reflect the percentage-of-completion method for each of the following:

2015 Entries  2016 Entries

2016 Entries

Definitions:

Townshend Duties

The Townshend Duties were a series of British taxes on colonies in America imposed in 1767 on imports such as tea, glass, and paper, which sparked widespread protests.

Lord North

was the Prime Minister of Great Britain from 1770 to 1782, best known for his leadership during the American Revolution and losing the American colonies for Britain.

Colonial Assemblies

Elected bodies of representatives in the American colonies that voiced local interests, passed laws, and challenged the authority of the British colonial governors.

Townshend Duties

A series of British acts passed in 1767, imposing taxes on the American colonies for imports such as tea, glass, and paper, leading to widespread protest.

Q12: In its "Objectives of Financial Reporting by

Q40: Financial statements elements arranged in basic financial

Q42: On January 1, 2014, Stacie signed a

Q44: Refer to Exhibit 15-5. At the end

Q45: Following the list below is a series

Q75: You are conducting a seminar for health

Q91: Accounting principles for defined benefit pension plans

Q96: Why do companies issue long term liabilities?<br>A)

Q130: On January 1, 2014, the Jim Corporation

Q133: What is the difference between the stated